| GRI 103-2 |

Management approach: The management approach and its components |

| GRI 103-3 |

Management approach: Evaluation of the management approach |

| GRI 201-1 |

Direct economic value generated and distributed |

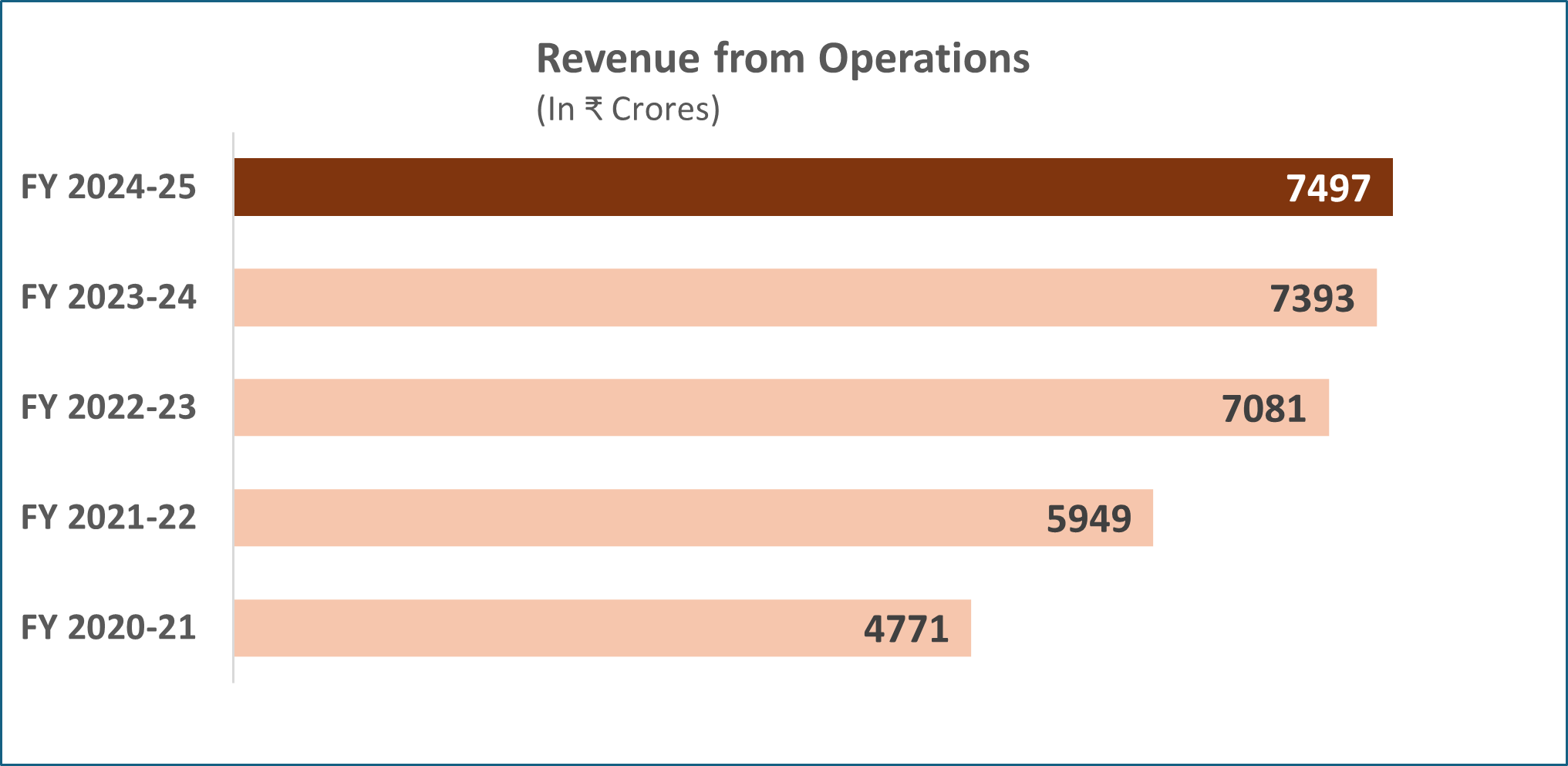

Net revenue: ₹ 7,496.71 Crores

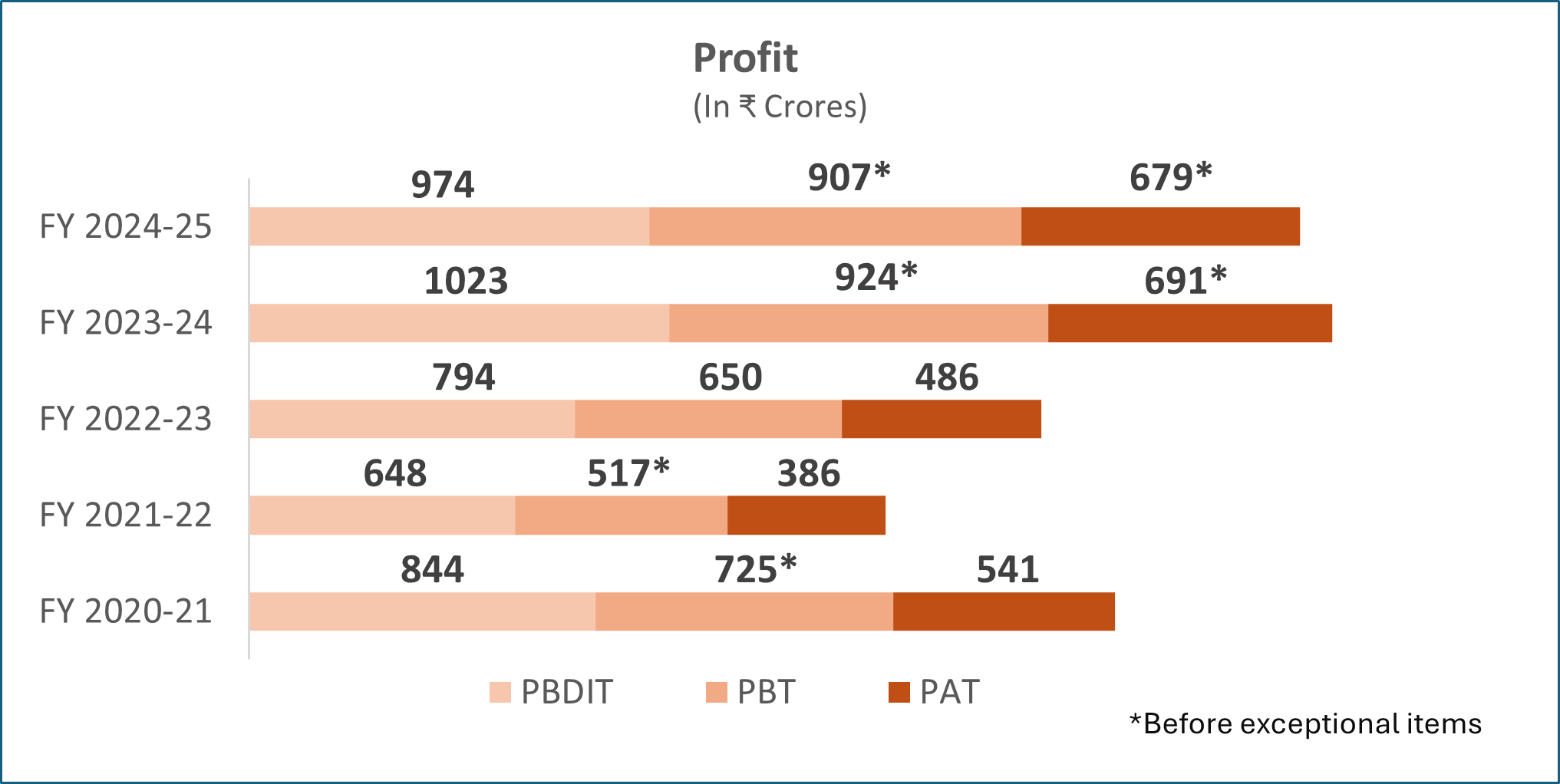

Profit after Tax: ₹ 1,021.24 Crores |

| GRI 201-2 |

Financial implications and other risks and opportunities due to climate change |

In response to the pressing environmental challenge of climate change, KNPL has adopted the Task Force on Climate-related Financial Disclosures (TCFD) framework in FY 2022-23 to assess and quantify its risks and opportunities. We have integrated the identified risks with our Enterprise Risk Management strategy. |

| GRI 201-3 |

Defined benefit plan obligations and other retirement plans |

Employee Benefits (Note 32, 39) |

| GRI 201-4 |

Financial assistance received from government |

Company received no financial assistance from government |